In today’s digital business world, automation has made everything faster - including billing. But there’s a hidden danger in this speed: automated invoices and recurring deductions that are quietly draining your company’s finances.

Whether it’s a forgotten subscription or a mismatched vendor invoice, I’ve seen firsthand through account and card statement reviews how these seemingly small charges add up to massive financial leakage.

Real Issues I’ve Encountered:

- 🔁 Auto-renewed services that companies are no longer using, but still being charged for - month after month.

- 🧾 Pre-authorized invoice deductions by vendors like insurance companies, often labeled vaguely and paid without question.

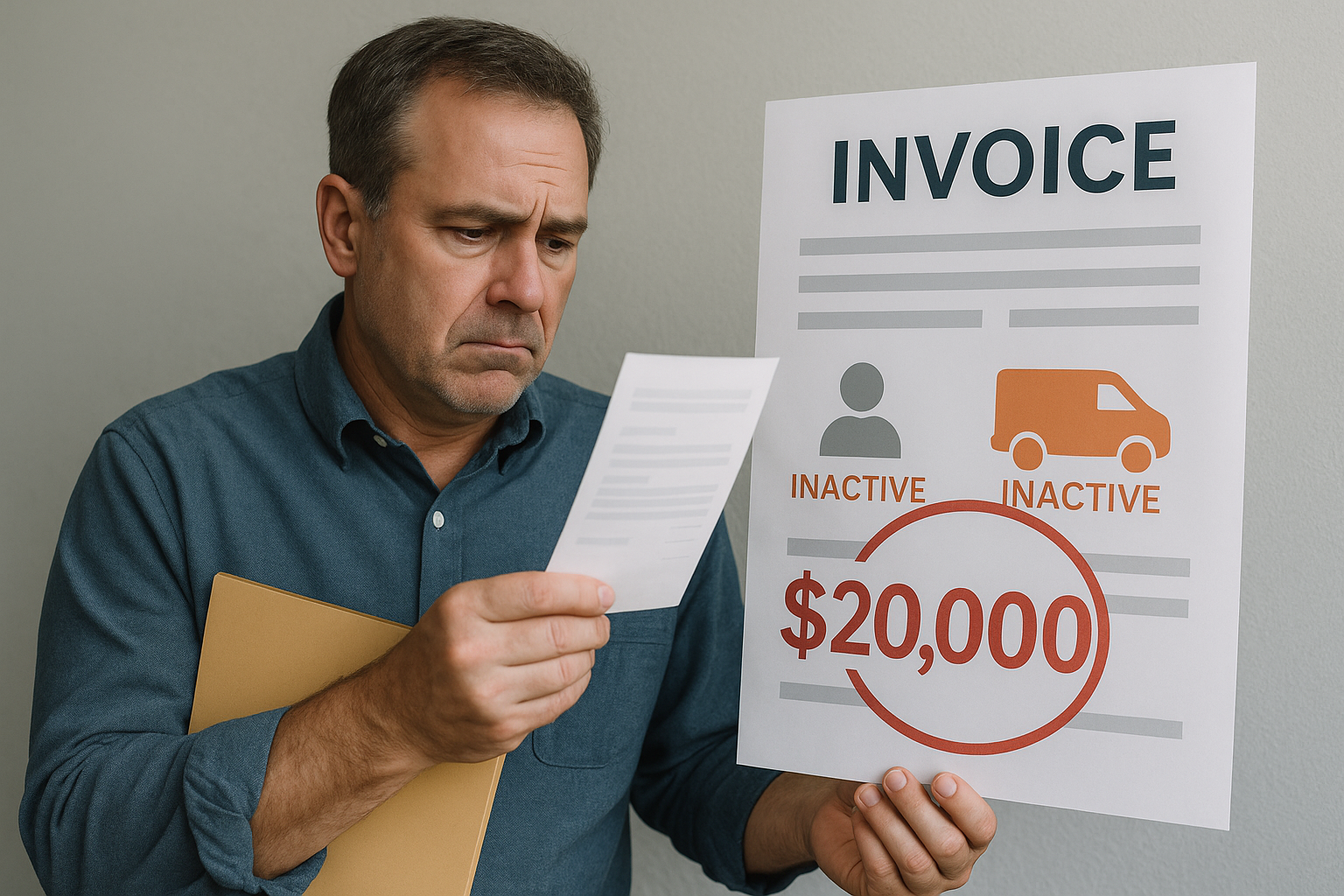

- 🚐 Per-unit billing errors, especially in industries like vehicle leasing or fleet insurance - where companies continue to charge for inactive or returned assets due to outdated records.

And let’s be honest - is it intentional or an honest mistake? Either way, the burden is on the business to spot and dispute those charges. And if you don’t, you won’t get your money back.

What Makes This Worse?

Many large companies now use automated invoice generation systems - which are not always connected to live data. For example:

- An insurance firm may charge per van per day, but if their system isn’t updated with your latest fleet data, you may be billed for vans you no longer use or own.

- Some SaaS tools still bill for users who have left the company.

- Vendors apply flat prepayments that don’t reflect usage or contract terms.

These invoices are automatically deducted from your account or credit card. And unless someone checks and disputes them in time, the money is gone - for nothing.

What the Research Shows

- 35% of businesses admit to paying for unused or outdated subscriptions every year (QuickBooks, 2023).

- In sectors with fleet operations, up to 10–15% of insurance or service invoices contain inaccuracies based on outdated asset data.

- Once billed, most vendors do not issue refunds unless the dispute is raised within 7–14 days.

What Can You Do?

To protect your business from this kind of profit bleed:

✅ Conduct monthly reconciliation of both card and bank accounts

✅ Cross-check invoices with actual asset or user data

✅ Flag and dispute every mismatch immediately — delays cost money

✅ Outsource or delegate this task to someone who knows what to look for

How DSPGrid Helps

At DSPGrid, we don’t just store your invoices — we track, verify, and protect your money:

- 🔍 Audit and flag mismatched invoices

- 🚐 Track active/inactive vehicles for correct billing validation

- 📥 Verify charges before they hit your account

- 🧾 Dispute incorrect vendor billing on your behalf

Many of our clients discovered thousands in overcharges from vendors who never updated their data — and we helped stop the leak.

Final Thoughts

Automation saves time, but without proper oversight, it can cost far more than it saves. If your business relies on automated deductions — whether for insurance, tools, software, or services — make sure you’re also investing in automated oversight.

Because every dollar lost to an unchecked invoice is a dollar stolen from your bottom line.

Book a reconciliation audit with us today

info@dspgrid.com